‘Helpless’: can Hong Kong logistics firms survive eviction? Uncertain future as government takes back New Territories brownfield sites

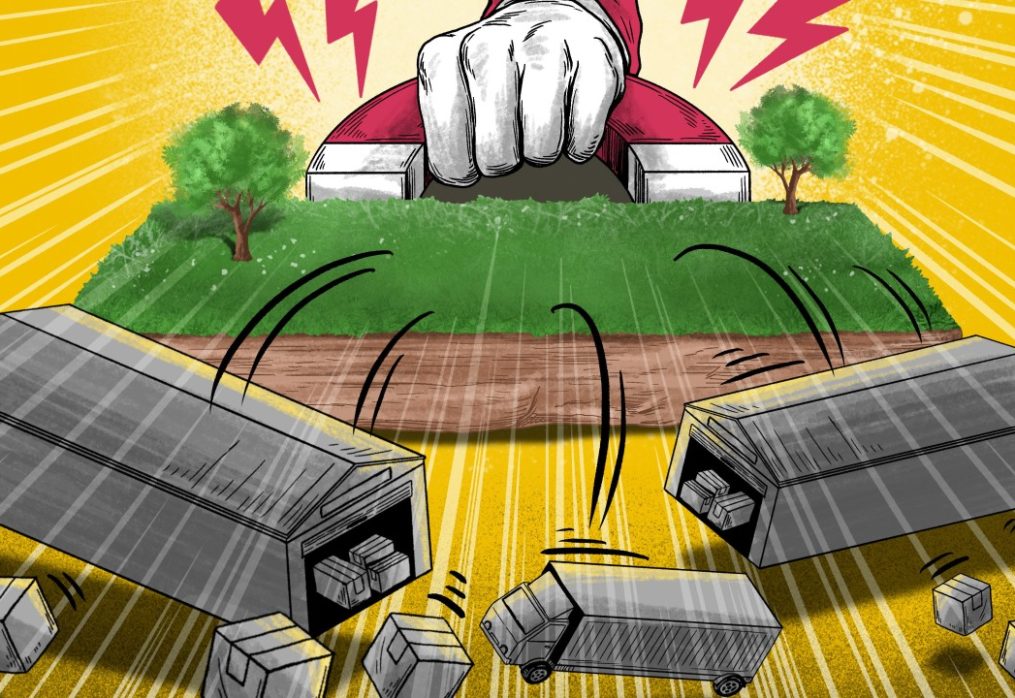

Hundreds of logistics operators are affected by a land resumption exercise there and in nearby Yuen Long South.

The Development Bureau told the first batch of operators in writing last December that they would have to move out next year. They had to wait for an official gazette announcement to know the deadline, usually within six months.

Besides the 30 hectares (74 acres) already acquired, the government is taking back 200 hectares of brownfield sites in the New Territories in phases by 2026, including those in Hung Shui Kiu and Yuen Long South.

Unable to find a new place to move to within his six-month deadline, Ching said: “I feel so helpless and very worried about the future. The government has not made any plans to relocate us. Everything is so chaotic.”

Hong Kong’s brownfield sites are designated as agricultural land but are no longer used for farming. They are occupied instead by warehouses, workshops and recycling yards, among various other industrial activities.

Business operators told to move out were concerned as the government said it would offer only financial compensation, not alternative sites for relocation.

Those affected have called for help to be resettled, saying up to half of them might be forced to close, and that would threaten the city’s logistics industry.

Hong Kong’s Paul Chan defends economic potential of land-reclamation projects

Hong Kong’s Paul Chan defends economic potential of land-reclamation projects

The Transport and Logistics Bureau last month unveiled a blueprint highlighting strategies to develop the industry.

They include efforts to stabilise the supply of land for the industry and develop logistics clusters in the Northern Metropolis, a massive development near the mainland border that will serve as a tech hub with homes for 2.5 million people and up to 650,000 jobs.

It has reserved 37 hectares for modern logistics development in the Northern Metropolis in the long run, including in Hung Shui Kiu.

The government also plans to dispose of four parcels of land covering about 19 hectares from 2024 to 2027 around the Kwai Tsing Container Terminals to develop multistorey logistics facilities.

Responding to questions from the Post about the business owners’ unhappiness, a Development Bureau spokesman said brownfield sites were being taken back in a “controlled manner”, with operators being allowed to stay on the land for a longer period.

“The government’s long-term objective is to develop multistorey buildings for modern industries to attain the dual policy objectives of supporting the development of industries and consolidating brownfield operations in a land-efficient manner,” he said.

The government will call tenders soon for the first batch of sites for multistorey buildings and the developer will have to set aside no less than 30 per cent of the floor space for leasing to the affected brownfield operators at a concessionary rent, according to the spokesman.

More suitable government land will also be identified for affected operators to rent on short-term tenancies.

Hong Kong’s trading and logistics industry accounted for almost a quarter of the local gross domestic product (GDP) in 2021. The logistics industry alone contributed 6.2 per cent of Hong Kong’s GDP and its 185,500 jobs accounted for 5.1 per cent of local employment.

However, the industry has been under threat from increasingly keen regional competition in the region.

Hong Kong has fallen in global rankings from the top spot to the ninth busiest container port last year. Shanghai was No 1, followed by Singapore, Ningbo-Zhoushan, Shenzhen and Qingdao.

Hong Kong to help finance Northern Metropolis project with land exchange scheme

Hong Kong to help finance Northern Metropolis project with land exchange scheme

Despite assurances, businessman Ching said the government’s relocation sites were too few to resettle all the affected operators.

“The options on offer are too little, too late. Many can’t survive or wait till 2027 to be relocated,” he said.

From December 2020 to November last year, the government offered only eight sites for short-term tenancy with a total area of almost 200,000 sq ft, while tenders have been called for another three sites with an area of more than 48,000 sq ft.

From July 2019 to November last year, the government helped 21 business operators obtain planning permission, involving some 20.5 hectares of relocation sites.

Ching said other relocation options, such as finding land on their own in peripheral rural areas, proved too difficult.

“First, most of the peripheral rural sites lack transport facilities and are not suitable for logistics operations,” he said. “The roads are too narrow for cargo trucks.”

“Second, you need to sort out the very complex shared ownership of rural land which involves many joint owners. It’s like wrestling with them to get approval from all of them to lease the land. Soaring rent hikes in these areas also make our operations impossible.”

He said the government had rejected some sites he proposed for relocation, saying they were too near green belts and residential areas.

Yeung Siu-lun, the sales and marketing director of another firm told to move out next year, echoed Ching’s sentiments.

His company, Everhonor Logistics Management in Yuen Long, has occupied a 200,000 sq ft site since 2013 and has 200 employees. So far, it has not been able to find a suitable relocation site.

“All the available options are not feasible,” he said. “For some sites, the rent is sky high, while some peripheral land close to country parks is not suitable for logistics operations.”

Yeung’s firm transports products including cosmetics and electronics goods to the mainland for conglomerates including Cainiao, the logistics arm of Alibaba Group, JD Logistics and Taobao, the online shopping platform owned by Alibaba Group. Alibaba owns the Post.

Hong Kong government to set up 2 bodies to seek private funding for mega projects

Hong Kong government to set up 2 bodies to seek private funding for mega projects

He said the uncertainty over the company’s relocation had prompted his major clients to postpone renewing their annual contracts.

“I am very worried,” Yeung said. “I don’t know how we can continue our business when our major clients have put on hold the renewal of our contracts.”

He urged the authorities to resettle the affected operators before taking back their sites, saying the government’s blueprint for developing the city into an international smart logistics hub struck him as ironic.

“We need a stable location for long-term development,” he said. “A lot of logistics firms are prepared to shut down if they can’t find a new place to move to and are now only waiting for the government’s compensation.

“Without a well thought-out relocation plan for the industry, Hong Kong has effectively handed over its logistics business to Shenzhen and other places on the mainland.”

Yeung said if he could not find a relocation site before his deadline, he would downsize or move part of his operations across the border.

Hong Kong’s logistics sector eyes smart digital technology

Hong Kong’s logistics sector eyes smart digital technology

Under the government’s compensation policy, only operators that set up their business on affected sites before May 2016 qualified for compensation. Those who failed to get waivers from their landlords for erecting open-air structures such as sheds and coverings would receive less.

Joe Chan Kai-chung, director of Able Union International Supply Chain, which moved to Yuen Long in 2019 and transports cosmetic goods to the mainland, said he was prepared to quit the industry if he did not get compensation.

“I have no choice,” he said. “I don’t think I can afford the rent in other places which has jumped up by more than 30 per cent,” he said.

Calaf Lau Chi-foo, director of MFS Logistics operating a 100,000 sq ft warehouse in Yuen Long, said he might get only a little compensation under the government’s stringent rules.

Prepared to scale down his business by a third to relocate, he said: “Hong Kong really can’t compete with the mainland when everything here is so costly, such as salaries and rent.”

Liu Kwai-fung, director of Lai Long Logistics Company, said his firm invested more than HK$2 million (US$256,600) on facilities but would not get any compensation as the company moved to Yuen Long in 2020.

“We were totally in the dark about the government’s relocation plan,” he said. “We didn’t know that we would have to move out so soon without compensation.”

“I feel very down. I don’t want to give up my business but if I can’t find a new place, I have no choice but to shut down my firm.”

Stanley Chiang Chi-wai, chairman of the Hong Kong Land Transport Council, urged the government to adopt a flexible approach to the land resumption timetable.

“Over half the affected firms will fail to find a new place to continue their operations if the authorities insist that they move out as scheduled,” he said. “This will be a blow to the logistics industry.”

Hong Kong to set up logistics data platform connecting city’s transport hubs

Hong Kong to set up logistics data platform connecting city’s transport hubs

Chiang said the government should not only emphasise developing high value-added operations as other types of businesses also mattered for the industry’s survival.

He suggested postponing the land resumption as the authorities had already identified sites for about 410,000 public flats in the next decade, more than enough to meet the demand for 308,000 homes.

“The government could give the affected firms more time to find land and upgrade their businesses,” he said.

Louis Chan Wing-kin, deputy director of research at the Trade Development Council, said Hong Kong’s emphasis was on high-value-added logistics services that relied more heavily on air transport and needed less land.

“Hong Kong’s logistics industry should move towards high value-added services such as international e-commerce, packaging or marketing services,” he said.

The industry’s land use needs had changed, he added. With traditional sea transport shrinking, Hong Kong should move away from the traditional business model of using warehouses and transporting goods by land.

Hong Kong Airport Authority to use logistics park to cement position as cargo hub

Hong Kong Airport Authority to use logistics park to cement position as cargo hub

Instead, Hong Kong should focus on smart logistics management services such as digitalised clearance, insurance coverage, financing, maritime settlements and arbitration, and export credit guarantees.

“Hong Kong can showcase its strengths in these areas where it has a competitive edge over other regional cities,” Chan said.

The Transport and Logistics Bureau said it would continue to work with relevant departments to plan for more land in the New Territories to support the ongoing development of the industry.

“Our goal is to achieve a seamless supply of logistics land for modern logistics development from the short and medium to the long term,” it said.